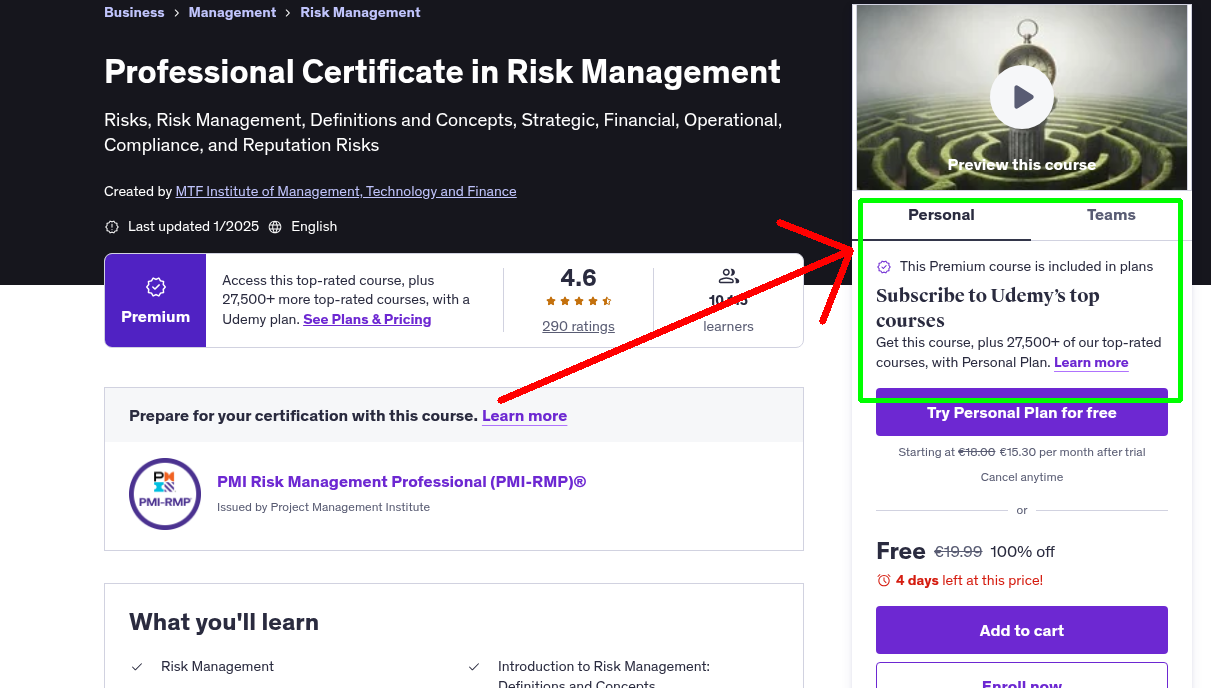

What You'll Learn

- Risk Management

- Introduction to Risk Management: Definitions and Concepts

- Importance of Risk Management for Organisations

- Types of Risks: Strategic, Financial, Operational, Compliance, and Reputational Risks

- Risk Identification: Recognising and Assessing Risks

- Risk Analysis Techniques

- Risk Appetite and Risk Tolerance

- Risk Mitigation Strategies: Avoidance, Reduction, Transfer, and Acceptance

- Risk Monitoring and Control

- Enterprise Risk Management (ERM): Integrated Approach to Managing Risks Across the Organisation

- Risk Management Frameworks and Standards: COSO, ISO 31000

Requirements

- For a better learning experience, we suggest you to use a laptop / mobile phone / pen and paper for taking notes, highlighting important points, and making summaries to reinforce your learning.

Who This Course is For

- No special requirements. A course for anyone who wants to build career in business and risks

- Risk management is the process of identifying, assessing, and controlling potential threats to an organization. These threats, or risks, could stem from a wide variety of sources. Here are the main focuses of risk management: Identification: Finding potential risks that could affect your organization or project. This involves brainstorming, looking at past issues, and considering what might happen in the future. Assessment: Determining the likelihood of those risks happening and how severe the impact would be if they did. This helps prioritize which risks need the most attention. Control: Taking steps to reduce the likelihood of the risks happening or to minimize their impact if they do. This might involve things like putting safety procedures in place, buying insurance, or having backup plans.

- Why is it important? Minimizes losses: By identifying and managing risks, companies can reduce financial losses, protect their reputation, and avoid legal issues. Improves decision-making: Risk management provides a framework for making informed decisions, considering potential downsides and opportunities. Enhances resilience: It helps companies to be prepared for unexpected events and to bounce back quickly from setbacks. Increases the likelihood of success: By addressing potential problems proactively, companies can increase their chances of achieving their goals.

- For managers specifically: Protects their team: Managers are responsible for the safety and well-being of their team. Risk management helps them create a safe work environment and minimize potential harm. Builds trust: Employees trust managers who are prepared and take steps to protect them from risks. Improves performance: When risks are managed effectively, employees can focus on their work without worrying about potential problems. In uncertain world, risk management is more critical than ever. It's an essential skill for companies and managers who want to thrive in the face of challenges.

Your Instructor

MTF Institute of Management, Technology and Finance

Institute of Management, Technology and Finance

4.4 Instructor Rating

101,718 Reviews

970,300 Students

274 Courses

Never Miss a Coupon!

Subscribe to our newsletter to get daily updates on the latest free courses.