How Data Science is Transforming the Finance Industry

Explore how data science revolutionizes finance through fraud detection, algorithmic trading, credit scoring, and risk management. Learn about machine learning applications, tools, challenges, and future trends in financial technology.

Picture this: a bank processes millions of transactions every day, each one containing valuable information that could reveal fraud patterns, predict market trends, or assess credit risks. Just a decade ago, much of this data went unused, buried in databases while financial decisions relied heavily on traditional methods and human intuition. Today, data science has fundamentally changed this landscape, turning raw financial data into actionable insights that drive smarter decisions, reduce risks, and create competitive advantages. From preventing fraudulent transactions in real-time to enabling algorithmic trading that executes thousands of trades per second, data science has become the backbone of modern finance.

The financial industry generates an enormous amount of data every second – market prices, transaction records, customer interactions, economic indicators, and social sentiment. Traditional analysis methods simply can't keep pace with this data explosion. Data science provides the tools and techniques needed to extract meaningful patterns from this information, enabling financial institutions to make faster, more accurate decisions. Whether it's detecting suspicious activity, predicting market movements, or personalizing financial products, data science has become essential for staying competitive in today's financial landscape.

Key Applications of Data Science in Finance

Data science applications in finance span across virtually every aspect of financial services, from day-to-day operations to strategic decision-making. These applications not only improve efficiency and accuracy but also enable entirely new business models and services that weren't possible before. Let's explore the most impactful ways data science is being used in the financial world today.

Fraud Detection and Prevention

Financial fraud costs the global economy billions of dollars annually, making fraud detection one of the most critical applications of data science in finance. Modern fraud detection systems use machine learning algorithms to analyze transaction patterns, user behavior, and contextual information in real-time. These systems can identify suspicious activities within milliseconds, often catching fraudulent transactions before they're completed. Unlike traditional rule-based systems, machine learning models can adapt to new fraud patterns and detect previously unknown types of fraudulent behavior.

Credit Scoring and Risk Assessment

Traditional credit scoring relied primarily on credit history and basic demographic information. Data science has revolutionized this process by incorporating alternative data sources such as social media activity, mobile phone usage patterns, online shopping behavior, and even satellite data. This approach enables more accurate risk assessment and helps extend credit to underserved populations who might lack traditional credit histories. Advanced models can predict default probabilities with greater precision, helping lenders make better decisions while expanding access to credit.

Algorithmic Trading and Market Analysis

Algorithmic trading uses data science to execute trades automatically based on predefined strategies and real-time market analysis. These systems can process vast amounts of market data, news sentiment, and economic indicators to make split-second trading decisions. High-frequency trading algorithms can execute thousands of trades per second, capitalizing on tiny price differences that human traders could never detect or act upon quickly enough. Machine learning models also help in developing trading strategies by identifying complex patterns in historical market data.

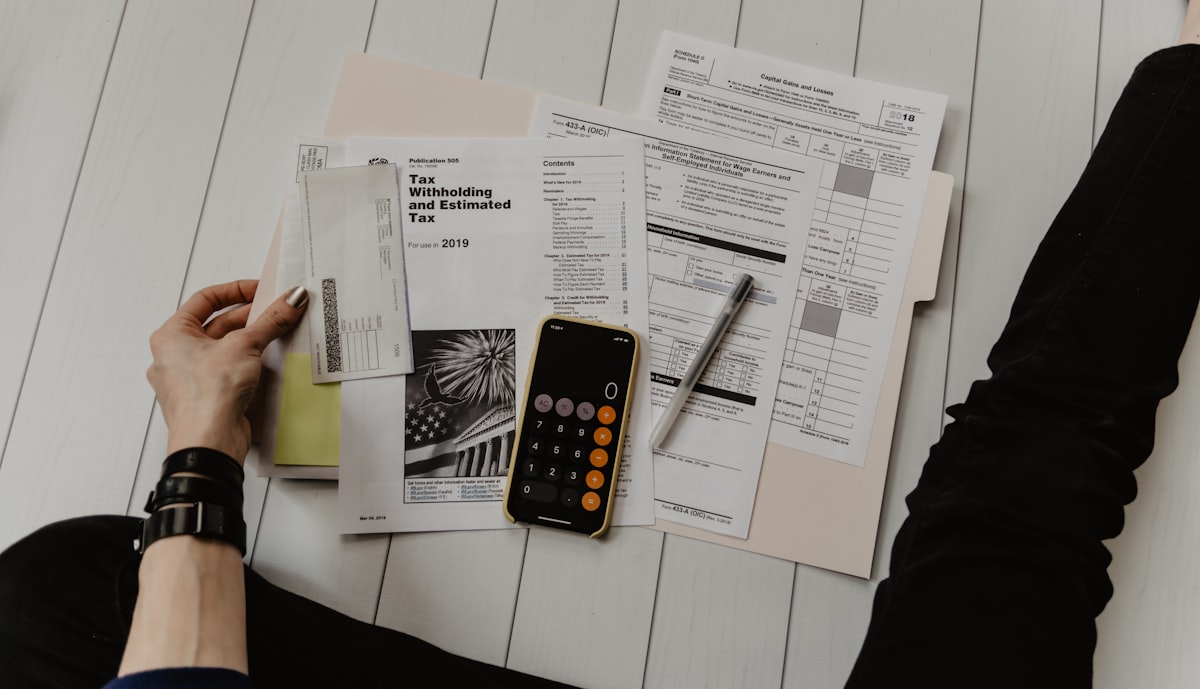

Modern financial institutions rely on data science for real-time market analysis and automated trading decisions

| Application Area | Primary Use Case | Key Benefits | Example Implementation |

|---|---|---|---|

| Fraud Detection | Real-time transaction monitoring | Reduced losses, faster detection | PayPal's machine learning fraud prevention |

| Credit Scoring | Alternative risk assessment | Better accuracy, financial inclusion | Lenddo's social data credit scoring |

| Algorithmic Trading | Automated market strategies | Speed, precision, 24/7 operation | Renaissance Technologies' Medallion Fund |

| Risk Management | Portfolio optimization | Better diversification, risk control | JPMorgan's LOXM trading algorithm |

| Customer Analytics | Personalized financial products | Higher satisfaction, cross-selling | Bank of America's Erica AI assistant |

| Regulatory Compliance | Automated reporting and monitoring | Reduced costs, accuracy | Wells Fargo's regulatory technology platform |

| Insurance Underwriting | Dynamic pricing models | Fair pricing, risk assessment | Progressive's usage-based auto insurance |

| Robo-Advisory | Automated investment management | Lower fees, accessibility | Betterment's portfolio management algorithms |

The Role of Machine Learning and AI in Finance

Machine learning and artificial intelligence form the technological backbone of modern financial data science. These technologies enable computers to learn from data patterns without being explicitly programmed for every scenario. In finance, this capability is particularly valuable because financial markets are complex, dynamic systems where patterns constantly evolve. Machine learning models can adapt to changing conditions and discover subtle relationships in data that traditional statistical methods might miss.

Financial Forecasting and Predictive Analytics

Predictive models in finance help institutions forecast everything from stock prices and currency fluctuations to customer behavior and economic trends. Time series analysis, neural networks, and ensemble methods are commonly used to predict future values based on historical patterns. These models consider multiple variables simultaneously – economic indicators, market sentiment, seasonal patterns, and external events – to generate more accurate predictions than traditional forecasting methods.

Anomaly Detection and Pattern Recognition

Anomaly detection algorithms excel at identifying unusual patterns that deviate from normal behavior. In finance, this capability is crucial for detecting fraud, market manipulation, system failures, and operational risks. Unsupervised learning techniques can identify anomalies without prior knowledge of what suspicious behavior looks like, making them particularly effective at catching new types of threats. These systems continuously learn what 'normal' looks like for different contexts and alert human analysts when something appears suspicious.

Common Machine Learning Models in Finance

- **Random Forest**: Excellent for credit scoring and risk assessment due to interpretability and robustness

- **Neural Networks**: Powerful for pattern recognition in market data and fraud detection

- **Support Vector Machines**: Effective for classification tasks like loan approval decisions

- **LSTM Networks**: Specialized for time series forecasting in trading and market analysis

- **Gradient Boosting**: High accuracy for complex prediction tasks like default probability

- **Clustering Algorithms**: Useful for customer segmentation and market analysis

- **Reinforcement Learning**: Emerging applications in portfolio optimization and trading strategies

- **Natural Language Processing**: Analyzing news sentiment and regulatory documents

Machine learning models process complex financial data to generate insights and predictions for better decision-making

Data Sources and Tools Used in Financial Data Science

Financial data science relies on diverse data sources and sophisticated tools to extract insights from complex financial information. The quality and variety of data sources directly impact the effectiveness of analytical models, while the choice of tools determines how efficiently data scientists can work with this information. Understanding these resources is essential for anyone looking to work in financial data science or implement data-driven solutions in financial institutions.

Key Financial Data Sources

- **Market Data**: Real-time and historical prices, trading volumes, and market indicators from exchanges

- **Alternative Data**: Satellite imagery, social media sentiment, web scraping, and IoT sensor data

- **Economic Indicators**: GDP, inflation rates, employment data, and central bank communications

- **Corporate Data**: Financial statements, earnings reports, SEC filings, and company announcements

- **Customer Data**: Transaction records, account information, and behavioral patterns

- **Credit Data**: Credit scores, payment histories, and loan performance data

- **Regulatory Data**: Compliance reports, stress test results, and regulatory filings

- **News and Social Media**: Financial news, analyst reports, and social sentiment analysis

Essential Tools and Technologies

| Tool Category | Popular Tools | Primary Use | Best For |

|---|---|---|---|

| Programming Languages | Python, R, SQL, Julia | Data analysis and modeling | Statistical analysis and machine learning |

| Data Manipulation | Pandas, NumPy, dplyr, data.table | Data cleaning and transformation | Preparing datasets for analysis |

| Machine Learning | scikit-learn, TensorFlow, PyTorch, Keras | Building predictive models | Advanced analytics and AI applications |

| Visualization | Matplotlib, Plotly, ggplot2, D3.js | Creating charts and dashboards | Communicating insights to stakeholders |

| Development Environment | Jupyter Notebooks, RStudio, PyCharm | Interactive development | Rapid prototyping and collaboration |

| Big Data Processing | Apache Spark, Hadoop, Kafka | Large-scale data processing | Real-time and batch data processing |

| Financial APIs | Bloomberg API, Yahoo Finance, Quandl | Market data access | Real-time market information |

| Cloud Platforms | AWS, Google Cloud, Azure | Scalable computing resources | Production deployment and scaling |

| Database Systems | PostgreSQL, MongoDB, InfluxDB | Data storage and retrieval | Structured and time-series data |

| Version Control | Git, GitHub, GitLab | Code management | Collaboration and reproducibility |

Case Study: How a Bank Uses Data Science for Credit Risk Assessment

Let's walk through a realistic example of how a mid-sized bank might implement data science to improve their credit risk assessment process. This case study illustrates the practical application of the concepts we've discussed and shows how data science creates tangible business value in financial institutions.

The Challenge: Improving Credit Decisions

MidBank (a hypothetical institution) was experiencing two problems with their traditional credit scoring system: they were approving too many loans that eventually defaulted, and they were rejecting creditworthy applicants who had limited credit history. Their existing system relied heavily on FICO scores and basic income verification, missing important signals that could improve decision accuracy. The bank wanted to reduce default rates while expanding access to credit for underserved customers.

The Data Science Solution

- **Data Collection**: Gathered traditional credit data plus alternative sources like bank transaction patterns, utility payments, and mobile phone usage

- **Feature Engineering**: Created new variables such as spending stability, income volatility, and payment timing patterns

- **Model Development**: Built ensemble models combining logistic regression, random forest, and gradient boosting algorithms

- **Model Validation**: Tested models on historical data and implemented A/B testing for new applications

- **Risk Monitoring**: Developed dashboards to track model performance and detect potential bias or drift

- **Continuous Improvement**: Established feedback loops to retrain models as new data becomes available

Results and Business Impact

After implementing the new data science-driven credit scoring system, MidBank saw remarkable improvements. Default rates decreased by 23% while loan approvals for qualified applicants increased by 15%. The bank was able to offer competitive rates to low-risk customers while appropriately pricing loans for higher-risk applicants. Perhaps most importantly, they extended credit to 12,000 additional customers who would have been rejected under the old system, many of whom were from underserved communities with limited traditional credit history.

Modern banks use data science to make more accurate and fair credit decisions while expanding access to financial services

Benefits of Data Science for Financial Institutions

The adoption of data science in finance brings transformative benefits that extend far beyond simple cost savings or efficiency gains. These advantages create competitive differentiation and enable entirely new business models that weren't possible with traditional approaches. Let's explore the key benefits that make data science investment essential for modern financial institutions.

- **Enhanced Decision Making**: Data-driven insights replace gut feelings with evidence-based choices, leading to more accurate and consistent decisions across all business areas

- **Risk Reduction**: Advanced analytics identify potential risks before they materialize, from credit defaults to market volatility and operational failures

- **Process Automation**: Machine learning models automate routine decisions, freeing human experts to focus on complex cases and strategic initiatives

- **Personalized Customer Experience**: Data science enables tailored financial products and services that meet individual customer needs and preferences

- **Improved Operational Efficiency**: Automated processes and predictive maintenance reduce costs while improving service quality and speed

- **Regulatory Compliance**: Automated monitoring and reporting systems ensure consistent compliance with evolving financial regulations

- **Competitive Advantage**: Superior analytics capabilities enable faster innovation and better market positioning

- **Revenue Growth**: Better customer insights and risk management lead to increased profitable business and reduced losses

Measurable Business Impact

The financial industry has seen remarkable returns from data science investments. Leading banks report 15-25% reductions in operational costs through process automation, while fraud detection improvements have saved billions in prevented losses. Credit scoring enhancements typically improve loan performance by 10-20%, and personalized marketing campaigns show 2-3x higher response rates compared to traditional approaches. These measurable improvements demonstrate that data science isn't just a technological upgrade – it's a fundamental business transformation that drives bottom-line results.

Challenges and Ethical Concerns in Financial Data Science

While data science offers tremendous opportunities in finance, it also presents significant challenges that must be carefully managed. These challenges range from technical issues like data quality and model reliability to broader concerns about privacy, fairness, and regulatory compliance. Understanding and addressing these challenges is crucial for successful implementation of data science solutions in financial services.

Data Privacy and Security Concerns

Financial institutions handle some of the most sensitive personal information, making data privacy and security paramount concerns. The use of alternative data sources for credit scoring and customer analysis raises questions about consent and appropriate use of personal information. Additionally, the centralization of vast amounts of data creates attractive targets for cybercriminals, requiring robust security measures and careful access controls. Institutions must balance the benefits of comprehensive data analysis with respect for customer privacy and regulatory requirements like GDPR and CCPA.

Algorithmic Bias and Fairness Issues

Machine learning models can inadvertently perpetuate or amplify existing biases present in historical data. In lending, this could mean that models discriminate against certain demographic groups, even when sensitive attributes aren't directly used in the model. Ensuring algorithmic fairness requires careful attention to data collection, model development, and ongoing monitoring. Financial institutions must implement bias testing and fairness metrics to ensure their models make equitable decisions while remaining predictive and profitable.

Technical and Operational Challenges

- **Model Overfitting**: Models that perform well on historical data but fail on new, unseen data

- **Data Quality Issues**: Incomplete, inaccurate, or inconsistent data that undermines model performance

- **Model Interpretability**: Difficulty explaining complex model decisions to regulators and stakeholders

- **Concept Drift**: Changes in underlying patterns that make models less accurate over time

- **Integration Complexity**: Challenges incorporating new models into existing systems and workflows

- **Scalability Requirements**: Need for systems that can handle increasing data volumes and real-time processing

- **Talent Shortage**: Difficulty finding and retaining qualified data scientists with finance domain knowledge

- **Regulatory Uncertainty**: Evolving regulations around AI and algorithmic decision-making in finance

Future Trends: What's Next in FinTech and Data Science

The intersection of data science and finance continues to evolve rapidly, driven by technological advances, changing customer expectations, and regulatory developments. Emerging trends promise to further transform how financial services operate and compete. Understanding these trends is essential for professionals looking to build careers in this space and for institutions planning their technology investments.

Decentralized Finance and Blockchain Analytics

Decentralized Finance (DeFi) is creating new opportunities for data science applications in areas like automated market making, yield optimization, and risk assessment for decentralized protocols. Blockchain data provides unprecedented transparency, enabling new types of analysis around transaction patterns, network effects, and protocol performance. Data scientists are developing models to analyze on-chain metrics, predict token prices, and assess the risks of various DeFi protocols and strategies.

Real-Time Analytics and Edge Computing

The demand for real-time decision-making is pushing financial institutions toward edge computing and streaming analytics. This enables fraud detection, trading decisions, and risk monitoring to happen in milliseconds rather than minutes or hours. Technologies like Apache Kafka, real-time machine learning platforms, and 5G networks are making it possible to process and act on data at unprecedented speeds, creating new competitive advantages for early adopters.

Quantum Computing and Advanced AI

- **Quantum Computing**: Potential to revolutionize portfolio optimization, risk calculations, and cryptographic security

- **Explainable AI**: Advanced techniques for making complex models more interpretable and trustworthy

- **Federated Learning**: Collaborative model training that preserves data privacy across institutions

- **Computer Vision**: Automated document processing, identity verification, and asset valuation

- **Natural Language Processing**: Enhanced customer service, regulatory compliance, and market sentiment analysis

- **Augmented Analytics**: AI-powered tools that help non-technical users discover insights from data

- **Synthetic Data**: AI-generated datasets for model training while preserving privacy

- **Digital Twins**: Virtual models of financial systems for testing and optimization

Emerging technologies like quantum computing and advanced AI promise to further revolutionize financial data science

Learn More: Courses and Resources for Finance + Data Science

Building expertise in financial data science requires a combination of technical skills, domain knowledge, and practical experience. Whether you're coming from a finance background looking to add data science skills, or you're a data scientist interested in financial applications, there are excellent learning resources available to help you succeed in this exciting and lucrative field.

Recommended Learning Path for Financial Data Science

- **Mathematical Foundation**: Statistics, probability, linear algebra, and calculus fundamentals

- **Programming Skills**: Python or R programming with focus on data analysis libraries

- **Finance Fundamentals**: Financial markets, instruments, accounting, and risk management basics

- **Data Science Techniques**: Machine learning, data visualization, and statistical modeling

- **Financial Applications**: Specific use cases like credit scoring, fraud detection, and algorithmic trading

- **Regulatory Knowledge**: Understanding of financial regulations and compliance requirements

- **Practical Projects**: Hands-on experience with real financial datasets and business problems

- **Continuous Learning**: Staying current with new technologies, regulations, and market developments

Top Learning Resources for Financial Data Science

CFA Institute Programs

Professional certification programs covering financial analysis and quantitative methods

Coursera Financial Engineering

Stanford's comprehensive program covering mathematical finance and computational methods

DataCamp Finance Tracks

Interactive courses covering Python and R for financial analysis and modeling

edX MIT Finance Courses

MIT's finance and analytics courses including machine learning for finance

Quantitative Finance on Udemy

Practical courses in algorithmic trading, risk management, and financial modeling

QuantStart Learning Resources

Comprehensive tutorials and articles on quantitative finance and algorithmic trading

Kaggle Finance Competitions

Real-world finance data science competitions and datasets for practice

FRM Certification (GARP)

Financial Risk Manager certification covering quantitative risk analysis

Tips for Success in Financial Data Science

- **Build Domain Knowledge**: Understanding finance is just as important as technical skills – study financial markets, instruments, and regulations

- **Practice with Real Data**: Use financial APIs and datasets to work on realistic projects that demonstrate your skills

- **Network with Professionals**: Join fintech meetups, conferences, and online communities to learn from practitioners

- **Stay Ethical**: Always consider the ethical implications of your work, especially regarding bias and fairness

- **Focus on Communication**: Learn to explain complex technical concepts to non-technical stakeholders

- **Keep Learning**: The field evolves rapidly – stay current with new tools, techniques, and regulations

- **Understand the Business**: Know how your technical work translates to business value and regulatory compliance

Conclusion: The Growing Impact of Data Science on Finance

The transformation of finance through data science represents one of the most significant technological shifts in the industry's history. From improving fraud detection and credit decisions to enabling algorithmic trading and personalized financial services, data science has fundamentally changed how financial institutions operate, compete, and serve their customers. This isn't just about adopting new technology – it's about reimagining what's possible in financial services.

As we look toward the future, the opportunities for data science in finance continue to expand. Emerging technologies like quantum computing, advanced AI, and blockchain analytics promise to unlock new capabilities and business models. The institutions that invest in building strong data science capabilities today will be best positioned to capitalize on these future opportunities while better serving their customers and managing risks.

For individuals considering careers in this field, there has never been a better time to get involved. The demand for professionals who can bridge the gap between finance and data science continues to grow, while the tools and educational resources needed to build these skills are more accessible than ever. Whether you're looking to enhance your current role or transition into a new career, the combination of finance knowledge and data science skills opens doors to exciting and well-compensated opportunities.

Ready to explore the exciting intersection of data science and finance? Start your journey today by diving into our comprehensive collection of data science, programming, and finance courses. Whether you're just beginning or looking to advance your expertise, the knowledge and skills you need to succeed in financial data science are within reach. The future of finance is being shaped by data – and you can be part of it.

Tags:

Related Posts

Comments

Leave a Comment

No comments yet

Be the first to share your thoughts!